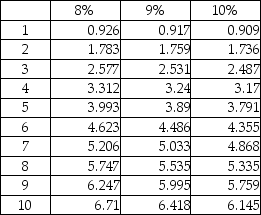

A company is considering an iron ore extraction project that requires an initial investment of $512,000 and will yield annual cash inflows of $156,000 for four years.The company's discount rate is 9%.What is the NPV of the project?

Present value of an ordinary annuity of $1:

A) $6560

B) $(102,400)

C) $102,400

D) $(6560)

Correct Answer:

Verified

Q101: Management's minimum desired rate of return on

Q102: Which of the following situations suggests the

Q105: An opportunity cost is the benefit foregone

Q110: When comparing several investments with the same

Q111: Net present value represents the difference between

Q115: Under conditions of limited resources,when a company

Q116: The discount rate used in a net

Q117: The net present value method of evaluating

Q120: Which of the following best describes the

Q121: Glossimer Thread Company is evaluating an investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents