Randolph Corporation is considering an investment opportunity with the expected net cash inflows of $300,000 for four years.The residual value of the investment,at the end of four years,would be $70,000.The company uses a discount rate of 14%,and the initial investment is $290,000.Calculate the NPV of the investment.

Present value of an ordinary annuity of $1:

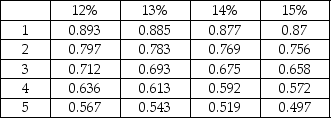

Present value of $1:

Correct Answer:

Verified

Q133: The following information is provided by Bethel

Q134: The following information is provided by Chelsa

Q135: If an investment's internal rate of return

Q135: Thom Corporation is considering an investment opportunity

Q137: Anderson Corporation is considering an investment opportunity

Q138: The internal rate of return (IRR)is the

Q140: The following information is provided by Cupola

Q141: Clear Cable Company is considering investing $450,000

Q142: Osprey Company is considering purchasing a new

Q143: What are the strengths of the net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents