Moonbeam Company is considering purchasing a new machine for $80,000.The new facility will generate annual net cash inflows of $20,000 for six years.At the end of the six years the machine will have no residual value.The company uses straight-line depreciation,and its stockholders demand an annual return of 12% on investments of this nature.

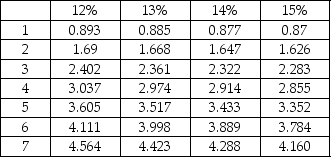

Present value of an ordinary annuity of $1:

Requirements

1.Compute the payback,the ARR,the NPV,the IRR,and the profitability index of this investment.

2.Recommend whether the company should invest in this project.

Correct Answer:

Verified

ARR:

NPV:

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q141: Clear Cable Company is considering investing $450,000

Q141: List two strengths and one weakness of

Q142: Many service,merchandising,and manufacturing firms use discounted cash

Q142: Osprey Company is considering purchasing a new

Q143: What are the strengths of the net

Q144: The discounted cash flow methods of evaluating

Q145: Sensitivity analysis is a technique that _.

A)

Q147: When evaluating a potential investment,managers should use

Q150: Investment methods,such as net present value and

Q151: Beam Cable Company is considering investing $450,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents