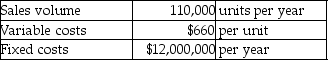

Electron Manufacturing is a price-taker.Electron produces large spools of electrical wire in a highly competitive market;thus,the company uses target pricing.The current market price of the electric wire is $760 per unit.The company has $3,200,000 in average assets,and the desired profit is a return of 5% on assets.Assume all products produced are sold.The company provides the following information:

If variable costs cannot be reduced,how much reduction in fixed costs will be needed to achieve the profit target?

A) $1,160,000

B) $12,000,000

C) $1,000,000

D) $12,160,000

Correct Answer:

Verified

Q64: Companies are price-takers when _.

A) their products

Q67: Delish Foods sells jars of special spices

Q67: Explain the difference between price-takers and price-setters.

Q73: Marionette Company manufactures dolls that are sold

Q75: Special pricing orders increase operating income if

Q76: Terra Potteryworks is a price-setter that uses

Q80: Fixed costs are relevant to a special

Q81: The income statement for Nighty Night,Inc.is divided

Q82: Briny Sail Makers manufactures sails for sailboats.The

Q83: The income statement for Eideldown,Inc.is divided by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents