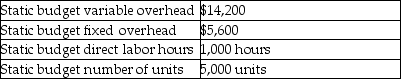

The following information relates to Tablerock Manufacturing's overhead costs for the month:

Tablerock allocates variable manufacturing overhead to production based on standard direct labor hours.

Tablerock reported the following actual results for last month: actual variable overhead,$14,500;actual fixed overhead,$5,400;actual production of 4,700 units at 0.22 direct labor hours per unit.The standard direct labor time is 0.20 direct labor hours per unit.

Compute the variable overhead cost variance.(Round intermediate calculations to two decimal places and the answer to the nearest dollar. )

Correct Answer:

Verified

** 4,700 units produced ×...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: List the direct labor variances and briefly

Q133: A company's production department was experiencing a

Q142: The fixed overhead volume variance is a

Q145: Meridian Fashions uses standard costs for their

Q147: Which of the following should be considered

Q150: Because it is a volume variance,the fixed

Q154: The fixed overhead cost variance measures the

Q155: The fixed overhead volume variance is a

Q156: Because it is a cost variance,the fixed

Q159: Cavalaris Products uses a standard cost system.Variable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents