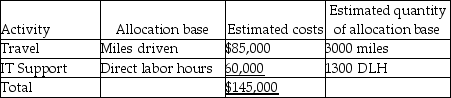

Hearthstone,Inc. ,a home healthcare firm,has been using a single predetermined overhead allocation rate with direct labor hours as the allocation base to allocate overhead costs.The direct labor rate is $200 per hour.Clients are billed at 190% of direct labor cost.Sofi Acosta,the president of Hearthstone,decided to develop an ABC system to more accurately allocate the indirect costs.She identified two activities related to the total indirect costs-travel and information technology (IT) support.The other relevant details are given below:

The predetermined overhead allocation rate for travel will be ________.(Round your answer to the nearest cent. )

A) $46.15 per mile

B) $28.33 per mile

C) $65.38 per mile

D) $48.33 per mile

Correct Answer:

Verified

Q81: Define target cost.How is target cost determined?

Q84: Which of the following is true about

Q96: Flasket,Inc.manufactures water bottles for children.Similar water bottles

Q104: Edgar Thompson,a CPA,has a firm in the

Q106: In service companies,activity-based management _.

A)results in more

Q108: Superior Services,Inc.is a consulting firm that offers

Q110: Bayou Snack Company manufactures gourmet dips along

Q111: When using an activity-based costing system in

Q113: Activity-based costing can be used in determining

Q116: The steps of an activity-based costing system

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents