On January 1,2019,Agree Company issued $85,000 of five-year,8% bonds when the market interest rate was 12%.The issue price of the bonds was $62,401.Agree uses the effective-interest method of amortization for bond discount.Semiannual interest payments are made on June 30 and December 31 of each year.Which of the following is the correct journal entry to record the first interest payment? (Round all amounts to the nearest whole dollar. )

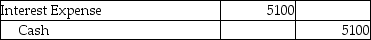

A)

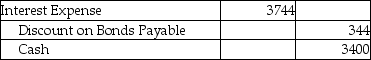

B)

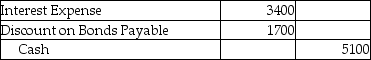

C)

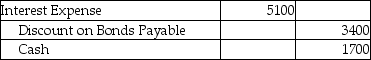

D)

Correct Answer:

Verified

Q181: When computing a bond's cash flow for

Q182: When using the effective-interest amortization method,the amount

Q183: Generally accepted accounting principles require that interest

Q190: The process for calculating present values is

Q193: The effective-interest amortization method allocates an amount

Q194: The face value of a bond is

Q198: When using the effective-interest amortization method,the amount

Q200: When computing the present value of a

Q201: On January 1,2019,Parker Advertising Company issued $50,000

Q202: When a bond is issued at a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents