For the month of September,Seawide Sales,Inc.recorded gross pay of $74,500.The net pay for the month amounted to $59,500.The salaries are paid on October 5.Which of the following is the journal entry for the payment of salaries?

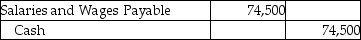

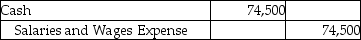

A)

B)

C)

D)

Correct Answer:

Verified

Q66: Income taxes are withheld from the employee's

Q69: Gross pay is the total amount of

Q81: Angie's gross pay for the week is

Q82: When using a payroll register,Salaries and Wages

Q82: Mountain Valley Sales, Inc. has gross pay

Q84: The current period earnings column of the

Q85: The income tax column in a payroll

Q85: A payroll register is a schedule that

Q87: Medicare taxes are a required column in

Q95: Dallas Corp. has gross pay for March

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents