Customer G.Smith owed Stonehollow Electronics $425.On April 27,2018,Stonehollow determined this account receivable to be uncollectible and wrote off the account.The company uses the direct write-off method.On July 15,2018,Stonehollow received a check for $425 from the customer.How should the July 15,2018 transaction be recorded?

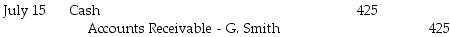

A)

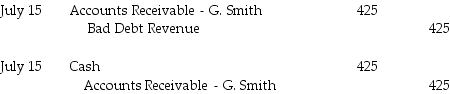

B)

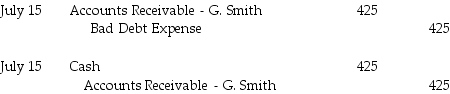

C)

D)

Correct Answer:

Verified

Q53: Which of the following statements is true

Q64: The use of the allowance method to

Q65: On January 1, Five Star Services has

Q67: A method of accounting for uncollectible receivables

Q71: The direct write-off method for uncollectible accounts

Q73: Which of the following statements regarding the

Q74: The allowance method of accounting for uncollectible

Q75: In order to keep accurate records about

Q77: The direct write-off method is only acceptable

Q78: A company with significant amounts of accounts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents