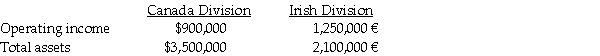

The Shamrock Corporation manufactures flower pots in Canada and Ireland.The operations are organized as decentralized divisions.The following information is available for the year just ended:

The exchange rate at the time of Shamrock's investment (the end of the previous year)in Ireland was $1.35 Canadian to 1.00 Euro.During the year,the Euro weakened steadily in value and the exchange rate at the end of the current year was 1.24 Canadian = $1.00 Euro.The average exchange rate during the year was 1.28 Canadian = $1.00 Euro.

Required:

a.Calculate the Canadian Division's ROI for last year based on dollars.

b.Calculate the Irish Division's ROI for last year based on Euros.

c.Which of Shamrock's two divisions earned the better ROI? Explain your answer,complete with supporting calculations showing the Irish Division ROI in Canadian dollars.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: An interactive control system is a formal

Q125: _ describes contexts in which, once risk

Q128: Moral hazard describes contexts in which, once

Q129: An important consideration in designing compensation arrangements

Q134: A multinational established a division in a

Q137: The only criticism of team-based compensation is

Q140: Well-designed compensation plans for executives focus on

Q159: The absence of good performance measures restricts

Q161: Briefly explain each of the four levers

Q166: "Levers of control," in addition to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents