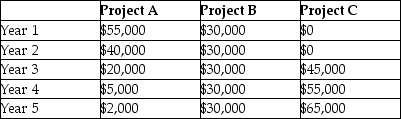

Lion Enterprises Inc.is evaluating 3 investment alternatives.Each alternative requires a cash outflow of $102,000.The cash inflows are summarized below (ignore taxes):

The company has a required rate of return of 9%.

Required:

Evaluate and rank each alternative using net present value (NPV).

Correct Answer:

Verified

NPV = $2,411.57

CF0 - $102,000...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Use the information below to answer the

Q63: Use the information below to answer the

Q64: Use the information below to answer the

Q65: Use the information below to answer the

Q71: What conflicts can arise between using discounted

Q73: Use the following information to determine which

Q74: The Zero Machine Company is evaluating a

Q76: Next Service Centre is considering purchasing a

Q77: After-tax savings from an operating cash inflow

Q79: A capital investment project typically has three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents