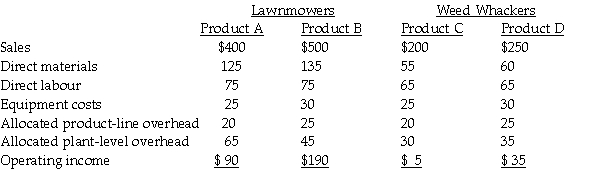

Garden Equipment Manufacturing Ltd.(GEM)has introduced a just-in-time production process and is considering the adoption of lean accounting principles to support its new production philosophy.The company has two product lines: lawnmowers and weed whackers.Two individual products are made in each line.The company's traditional cost accounting system allocates all plant-level overhead costs to individual products.Product-line overhead costs are traced directly to product lines,and then allocated to the two individual products in each line.Equipment costs are directly traced to products.The latest accounting report using traditional cost accounting methods included the following information (in thousands of dollars).

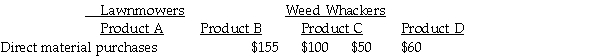

GEM has determined that each of the two product lines represents a distinct value stream.It has also determined that $90,000 of the allocated plant-level overhead costs represents plant occupancy costs associated with the products.Of this Product A occupies 30% of the plant's square footage,Product B occupies 30%,Product C occupies 20%,and Product D occupies 20%.The remaining square footage is occupied by plant administrative functions or is not being used.Finally GEM has determined that direct materials should be expensed in the period in which they are purchased,rather than when the material is used.According to purchasing records,direct material purchase costs during the year were:

Required:

a.What are the cost objects in GEM's lean accounting system? Which of GEM's costs would be excluded when computing operating income for these cost objects?

b.Compute the operating income for the cost objects identified in requirement b.using lean accounting principles.Why does operating income differ from the operating income computed using traditional accounting methods?

c.Which competitive strategy is best served by lean accounting principles?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q141: Falcon Industries manufactures customized industrial compounds.All processing

Q142: Key Smith Company manufactures all types of

Q143: Backflush costing does not strictly adhere to

Q144: Arrow Manufacturing Ltd.distributes golf clubs.Its annual demand

Q147: What are the principles of lean accounting?

Q147: Corry Corporation manufactures filters for cars,vans,and trucks.A

Q148: Tornado Electronics manufactures CD players.All processing is

Q149: Cyclone Electronics manufactures automobile radios.All processing is

Q150: Dolls "R" Us manufactures children's plastic dolls.For

Q154: Answer the following question(s)using the information below:

Complete

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents