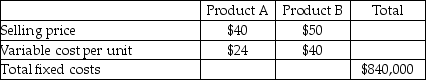

Mount Carmel Company sells only two products,Product A and Product B.

Mount Carmel sells two units of Product A for each unit it sells of Product B.Mount Carmel faces a tax rate of 30%.

Required:

a.What is the breakeven point in units for each product assuming the sales mix is 2 units of Product A for each unit of Product B?

b.What is the breakeven point if Mount Carmel's tax rate is reduced to 25%,assuming the sales mix is 2 units of Product A for each unit of Product B?

c.How many units of each product would be sold if Mount Carmel desired an after-tax net income of $73,500,facing a tax rate of 30%?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q142: Popcorn Inc.currently sells plain popcorn at the

Q145: Answer the following question(s)using the information below.The

Q146: Yurus Manufacturing Company produces two products,X and

Q148: Karen's Klothes sells blouses for women and

Q149: Determine the breakeven point in units based

Q150: Answer the following question(s)using the information below.The

Q151: Answer the following question(s)using the information below.The

Q153: Use the information below to answer the

Q157: Use the information below to answer the

Q158: Answer the following question(s)using the information below.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents