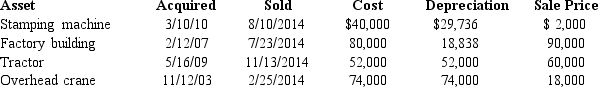

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as longterm capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: Section 1239 (relating to the sale of

Q44: Which of the following statements is correct?

A)When

Q45: Business equipment is purchased on March 10,2013,used

Q47: A business taxpayer sold all the

Q48: Lynne owns depreciable residential rental real estate

Q52: 44. Red Company had an involuntary conversion on

Q53: Which of the following events could result

Q54: Assume a building is subject to §

Q55: Orange Company had machinery destroyed by a

Q145: Vanna owned an office building that had

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents