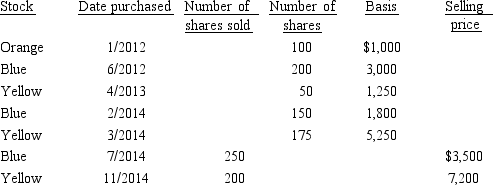

Omar has the following stock transactions during 2014:

a.What is Omar's recognized gain or loss on the stock sales if his objective is to minimize the recognized gain and to maximize the recognized loss?

b.What is Omar's recognized gain or loss if he does not identify the shares sold?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Hubert purchases Fran's jewelry store for $950,000.The

Q108: On September 18,2014,Jerry received land and a

Q109: Mitch owns 1,000 shares of Oriole Corporation

Q111: Ed and Cheryl have been married for

Q182: Ollie owns a personal use car for

Q197: Hilary receives $10,000 for a 15-foot wide

Q199: Marsha transfers her personal use automobile to

Q207: Monica sells a parcel of land to

Q217: Melody's adjusted basis for 10,000 shares of

Q254: Define fair market value as it relates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents