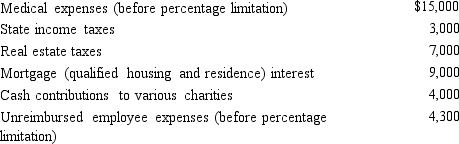

Mitch,who is single and age 66 and has no dependents,had AGI of $100,000 in 2014.His potential itemized deductions were as follows:  What is the amount of Mitch's AMT adjustment for itemized deductions for 2014?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2014?

A) $14,800

B) $16,800

C) $19,300

D) $25,800

E) None of these

Correct Answer:

Verified

Q61: Tad and Audria,who are married filing a

Q62: Eula owns a mineral property that had

Q63: Celia and Christian,who are married filing jointly,have

Q64: Ted,who is single,owns a personal residence in

Q65: 66. Wallace owns a construction company that builds

Q67: Omar acquires used 7-year personal property for

Q68: Vinny's AGI is $250,000.He contributed $200,000 in

Q69: Bianca and David have the following for

Q70: Marvin,the vice president of Lavender,Inc. ,exercises stock

Q71: Mauve,Inc. ,has the following for 2012,2013,and 2014

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents