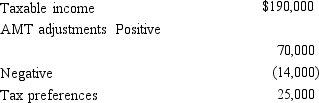

Use the following data to calculate Jolene's AMTI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: Omar acquires used 7-year personal property for

Q68: Vinny's AGI is $250,000.He contributed $200,000 in

Q69: Bianca and David have the following for

Q70: Marvin,the vice president of Lavender,Inc. ,exercises stock

Q71: Mauve,Inc. ,has the following for 2012,2013,and 2014

Q73: Gunter,who is divorced,has the following items for

Q74: Sand Corporation,a calendar year taxpayer,has alternative minimum

Q75: Akeem,who does not itemize,incurred a net operating

Q76: Use the following selected data to calculate

Q77: Arlene,who is single,has taxable income for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents