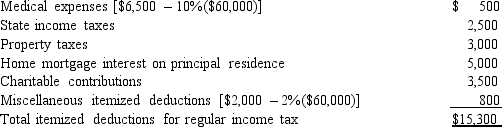

In calculating her 2014 taxable income,Rhonda,who is age 45,deducts the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: Kay,who is single,had taxable income of $0

Q79: In 2005,Collies exercised an incentive stock option

Q80: In 2014,Glenn had a $108,000 loss on

Q81: Will all AMT adjustments reverse? That is,do

Q82: In 2014,Linda incurs circulation expenses of $240,000

Q85: Lavender,Inc. ,incurs research and experimental expenditures of

Q88: Abbygail,who is single,had taxable income of $115,000

Q95: Frederick sells land and building whose adjusted

Q112: What is the relationship between the regular

Q112: What tax rates apply in calculating the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents