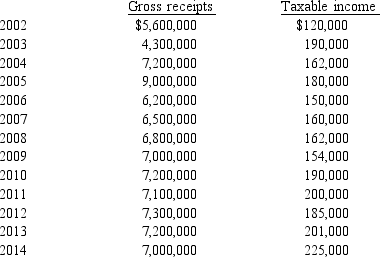

Sage,Inc. ,has the following gross receipts and taxable income:

Is Sage,Inc. ,subject to the AMT in 2014?

Is Sage,Inc. ,subject to the AMT in 2014?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q90: In May 2012,Swallow,Inc. ,issues options to Karrie,a

Q90: In June,Della purchases a building for $800,000

Q91: Melinda is in the 35% marginal tax

Q93: Beige,Inc. ,has AMTI of $200,000.Calculate the amount

Q97: Darin's,who is age 30,has itemized deductions

Q98: Lilly is single and has no taxable

Q104: Why is there a need for a

Q110: What is the relationship between taxable income

Q111: How can an AMT adjustment be avoided

Q115: What is the purpose of the AMT

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents