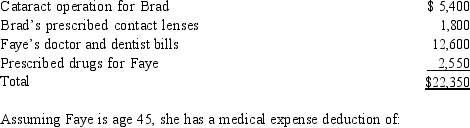

Brad,who would otherwise qualify as Faye's dependent,had gross income of $9,000 during the year.Faye,who had AGI of $120,000,paid the following medical expenses in 2014:

A)

B)

C)

D)

E) none of these

Correct Answer:

Verified

Q51: Contributions to public charities in excess of

Q55: John gave $1,000 to a family whose

Q57: Fred and Lucy are married,ages 33 and

Q60: Gambling losses may be deducted to the

Q61: Joseph and Sandra,married taxpayers,took out a mortgage

Q63: Your friend Scotty informs you that he

Q64: Rick and Carol Ryan,married taxpayers,took out a

Q65: Tom,age 48,is advised by his family physician

Q67: Pedro's child attends a school operated by

Q67: Karen,a calendar year taxpayer,made the following donations

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents