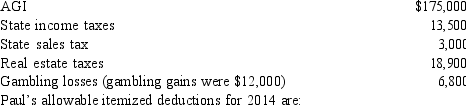

Paul,a calendar year married taxpayer,files a joint return for 2014.Information for 2014 includes the following:

A)

B)

C)

D) $42.200.

E) none of these

Correct Answer:

Verified

Q81: Harry and Sally were divorced three years

Q82: Helen pays nursing home expenses of $3,000

Q89: Diane contributed a parcel of land to

Q90: Linda is planning to buy Vicki's home.They

Q94: For calendar year 2014,Jon and Betty Hansen

Q96: Paul and Patty Black (both are age

Q97: Pat died this year.Before she died,Pat gave

Q99: George is single and age 56,has AGI

Q102: Linda borrowed $60,000 from her parents for

Q106: Joe, who is in the 33% tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents