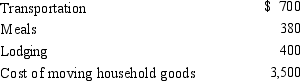

After graduating from college,Clint obtained employment in Omaha.In moving from his parents' home in

Baltimore to Omaha,Clint incurred the following expenses:

a.How much may Clint deduct as moving expense?

b.Would any deduction be allowed if Clint claimed the standard deduction for the year of the move? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Myra's classification of those who work for

Q106: For the current year,Wilbur is employed as

Q110: Jacob is a landscape architect who works

Q110: During 2014,Eva used her car as follows:

Q112: If a business retains someone to provide

Q113: Brian makes gifts as follows:

Recipient Cost of

Q116: For the current football season, Tern Corporation

Q117: Noah moved from Delaware to Arizona to

Q118: Arnold is employed as an assistant manager

Q119: Alfredo,a self-employed patent attorney,flew from his home

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents