Rocky has a full-time job as an electrical engineer for the city utility.In his spare time,Rocky repairs TV sets in the basement of his personal residence.Most of his business comes from friends and referrals from former customers,although occasionally he runs an ad in the local suburbia newspaper.Typically,the sets are dropped off at Rocky's house and later picked up by the owner when notified that the repairs have been made.

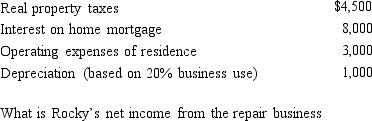

The floor space of Rocky's residence is 2,500 square feet,and he estimates that 20% of this is devoted exclusively to the repair business (i.e. ,500 square feet).Gross income from the business is $13,000,while expenses (other than home office)are $5,000.Expenses relating to the residence are as follows:

a.If he uses the regular (actual expense)method of computing the deduction for office in the home?

b.If he uses the simplified method?

Correct Answer:

Verified

Less: Expenses...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: For the current year,Wilbur is employed as

Q108: Once set for a year, when might

Q116: For the current football season, Tern Corporation

Q117: Noah moved from Delaware to Arizona to

Q118: Arnold is employed as an assistant manager

Q119: Alfredo,a self-employed patent attorney,flew from his home

Q128: Travel status requires that the taxpayer be

Q139: Nicole just retired as a partner in

Q145: Madison and Christopher are staff accountants at

Q152: Regarding tax favored retirement plans for employees

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents