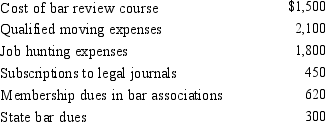

In the current year,Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Since Bo worked just part of the year,her salary was only $32,100.In terms of deductions from AGI,how much does Bo have?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Which, if any, of the following expenses

Q92: In terms of meeting the distance test

Q95: Ralph made the following business gifts during

Q100: Which, if any, of the following expenses

Q104: Rod uses his automobile for both

Q107: Paul is employed as an auditor by

Q115: Elsie lives and works in Detroit. She

Q125: In terms of income tax treatment, what

Q137: Taylor performs services for Jonathan on a

Q139: Cathy takes five key clients to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents