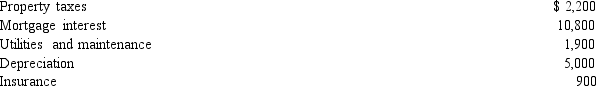

During the year,Rita rented her vacation home for twelve days for $2,400 and she used it personally for three months.The following expenses were incurred on the home:

Calculate her rental gain or loss and itemized deductions.

Calculate her rental gain or loss and itemized deductions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Max opened his dental practice (a sole

Q102: During the year, Jim rented his vacation

Q103: During the year,Martin rented his vacation home

Q105: Mattie and Elmer are separated and are

Q111: Calculate the net income includible in taxable

Q112: Can a trade or business expense be

Q124: Sandra sold 500 shares of Wren Corporation

Q124: Are all personal expenses disallowed as deductions?

Q127: Salaries are considered an ordinary and necessary

Q133: What losses are deductible by an individual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents