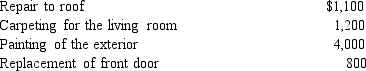

Marvin spends the following amounts on a house he owns:

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q115: Under what circumstance can a bribe be

Q116: Trade or business expenses are classified as

Q118: Bridgett's son, Clyde, is $12,000 in arrears

Q121: In distinguishing whether an activity is a

Q128: Discuss the application of the "one-year rule"

Q136: Bruce owns several sole proprietorships. Must Bruce

Q140: In applying the $1 million limit on

Q141: In a related-party transaction where realized loss

Q144: Briefly discuss the disallowance of deductions for

Q148: Why are there restrictions on the recognition

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents