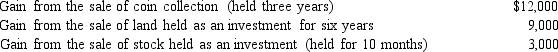

During 2014,Jackson had the following capital gains and losses:

a.How much is Jackson's tax liability if he is in the 15% tax bracket?

b.If his tax bracket is 33% (not 15%)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: Matching

Regarding classification as a dependent, classify

Q123: Deductions for AGI are often referred to

Q124: Mr. Lee is a citizen and resident

Q136: In meeting the criteria of a qualifying

Q137: The Deweys are expecting to save on

Q137: When can a taxpayer not use Form

Q140: During 2014,Addison has the following gains

Q142: In early 2014,Ben sold a yacht,held for

Q143: For 2014,Tom has taxable income of $48,005.When

Q145: Adjusted gross income (AGI) sets the ceiling

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents