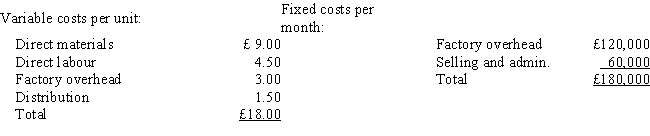

Miller Company produces speakers for home stereo units. The speakers are sold to retail stores for £30. Manufacturing and other costs are as follows: The variable distribution costs are for transportation to the retail stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

A San Diego wholesaler has proposed to place a special one-time order of 10,000 units at a reduced price of £24 per unit. The wholesaler would pay all distribution costs, but there would be additional fixed selling and administrative costs of £3,000. All other information remains the same as the original data. What is the effect on profits if the special order is accepted?

A) increase of £75,000

B) increase of £57,000

C) decrease of £168,000

D) increase of £12,000

Correct Answer:

Verified

Q46: Zandy Beverage Company plans to eliminate a

Q49: Miller Company produces speakers for home stereo

Q50: Boone Products had the following unit costs:

Q51: Reggie Ltd. manufactures a single product with

Q52: Boone Products had the following unit costs:

Q52: If the firm is at full capacity,

Q55: Which of the following is a qualitative

Q55: The following information pertains to the Ewing

Q56: Walton Company manufactures a product with the

Q59: Which of the following costs is NOT

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents