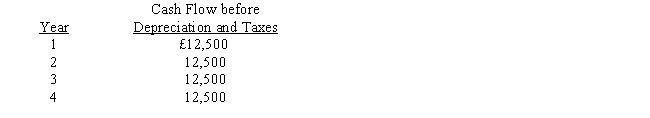

Jolly Corporation is considering an investment in equipment for £25,000. Data related to the investment are as follows: Jolly claims capital allowances using the straight-line method of depreciation . In addition, its tax rate is 40 percent, and the life of the equipment is four years with no salvage value. Cost of capital is 12 percent.

What is the net present value of the investment?

A) £30,370

B) £(2,222)

C) £12,962

D) £5,370

Correct Answer:

Verified

Q7: If the tax rate is 35 per

Q16: If the tax rate is 40 per

Q42: A firm is considering a project with

Q48: A firm is considering a project with

Q52: Which of the following is a capital

Q53: The internal rate of return model assumes

Q57: A company invests in a project that

Q65: After-tax cash flows from operations are calculated

Q67: If the tax rate is 40 percent

Q71: Tax savings from tax allowable depreciation (i.e.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents