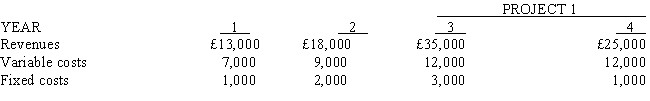

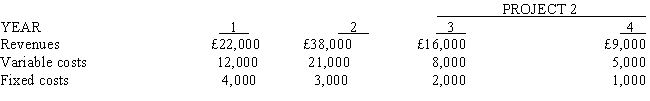

Maxim, Inc., is considering two mutually exclusive projects. Project 1 requires an investment of £40,000, while Project 2 requires an investment of £30,000. Cash revenues and cash costs for each project are shown below.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £3,000 and Project 2 would have a salvage value of £1,000.

The company estimates that at the end of the fourth year Project 1 would have a salvage value of £3,000 and Project 2 would have a salvage value of £1,000.

Required:

a.

Determine the net present value of EACH project using a 16 percent discount rate.

b.

Prepare a memorandum for management stating your recommendation. Include supporting calculations in good form.

Correct Answer:

Verified

Q3: A firm has £1,000,000 of long-term bonds

Q95: A capital investment project requires an investment

Q96: Van Dyke Company is evaluating a capital

Q97: Explain what a capital investment decision is.

Q99: Young Company has a tax rate of

Q101: Bert Corporation is considering an investment in

Q102: What types of non-quantitative factors can influence

Q103: Describe capital investment in the advanced manufacturing

Q104: What are the steps normally undertaken in

Q105: Redding Industries is considering the acquisition of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents