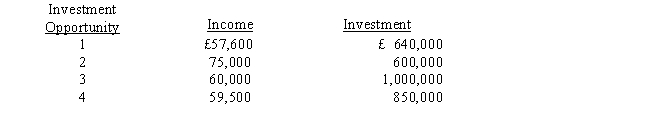

Doobey, Incorporated, has just formed a new division, and the following four investment opportunities are available to the division. The firm requires a minimum return of 8 percent.

Required:

a.

Calculate the return on investment (ROI) for each investment opportunity.

b.

If you were the division manager and you were evaluated based on ROI, which investment opportunity would you accept?

c.

If you were president of Doobey, Incorporated, which projects would you want the division to accept?

Correct Answer:

Verified

Q38: Which of the following is a disadvantage

Q62: Ms. Morris, a divisional manager, is compensated

Q63: Compare and discuss the advantages and disadvantages

Q64: The following results for the current year

Q65: The term "divisional margin" is used to

Q66: Beta Division had the following information: What

Q68: a. Identify advantages of a decentralized approach

Q69: Discuss the differences between centralized and decentralized

Q70: Mr. Baker, a divisional manager, is compensated

Q71: TotToys Ltd. recently made £2,000,000 of capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents