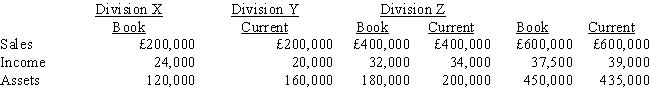

O'Neil Company requires a return on capital of 15 percent. The following information is available for 2002:

Required:

a.

Compute return on investment using both book and current values for each division. (Round answer to three decimal places.)

b.

Compute residual income for both book and current values for each division.

c.

Does book value or current value provide the better basis for performance evaluation?

d.

Which division do you consider the most successful?

Correct Answer:

Verified

Q26: _ exists when the major functions of

Q44: Compare and contrast return on investment (ROI)

Q76: Compare and contrast decentralization and centralization.

Q77: Explain why an organization should not use

Q78: The following information pertains to the three

Q80: Correll Company has two divisions, A and

Q81: Stevens Company has two divisions that report

Q82: Discuss how firms can evaluate manager performance

Q84: What problems do owners face in encouraging

Q86: Why do firms decentralize?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents