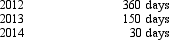

Shannon,a foreign person with a green card,spends the following days in the United States.  Shannon's residency status for 2014 is:

Shannon's residency status for 2014 is:

A) U.S.resident because she has a green card.

B) U.S.resident since she was a U.S.resident for the past immediately preceding two years.

C) Not a U.S.resident because Shannon was not in the United states for at least 31 days during 2014.

D) Not a U.S.resident since,using the three-year test,Shannon is not present in the United states for at least 183 days.

Correct Answer:

Verified

Q56: Generally, accrued foreign income taxes are translated

Q66: Which of the following situations requires the

Q69: OutCo, a controlled foreign corporation owned 100%

Q73: A controlled foreign corporation (CFC) realizes Subpart

Q78: RedCo, a domestic corporation, incorporates its foreign

Q83: Krebs,Inc.,a U.S.corporation,operates an unincorporated branch manufacturing operation

Q86: A non-U.S.individual's "green card" remains in effect

Q88: Which of the following statements regarding the

Q89: Kunst, a domestic corporation, generates $100,000 of

Q98: A U.S.corporation may be able to alleviate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents