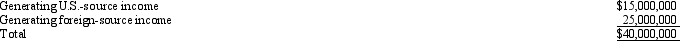

Goolsbee,Inc. ,a domestic corporation,generates U.S.-source and foreign-source gross income.Goolsbee's assets (tax book value)are as follows.

Goolsbee incurs interest expense of $200,000.Using the asset method and the tax book value,apportion interest expense to foreign-source income.

Goolsbee incurs interest expense of $200,000.Using the asset method and the tax book value,apportion interest expense to foreign-source income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q100: GlobalCo, a foreign corporation not engaged in

Q106: AirCo,a domestic corporation,purchases inventory for resale from

Q121: RainCo, a domestic corporation, owns a number

Q122: Which of the following statements regarding the

Q125: Present, Inc., a domestic corporation, owns 60%

Q125: The § 367 cross-border transfer rules seem

Q138: Which of the following statements regarding the

Q143: Your client holds foreign tax credit (FTC)

Q144: Britta,Inc. ,a U.S.corporation,reports foreign-source income and pays

Q146: Freiburg, Ltd., a foreign corporation, operates a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents