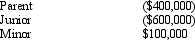

The Philstrom consolidated group reported the following taxable income amounts.Parent owns all of the stock of both Junior and Minor.Determine the net operating loss (NOL) that is apportioned to Parent.

A) $360,000.

B) $400,000.

C) $500,000.

D) $900,000.All NOLs of a consolidated group are apportioned to the parent.

Correct Answer:

Verified

Q41: ParentCo owned 100% of SubCo for the

Q45: ParentCo owned 100% of SubCo for the

Q67: Which of the following statements is true

Q70: ParentCo and SubCo had the following items

Q70: The Harris consolidated group reports a net

Q71: ParentCo and SubOne have filed consolidated returns

Q72: Which of the following items is not

Q75: ParentCo and SubCo have filed consolidated returns

Q77: The Philstrom consolidated group reported the following

Q78: The consolidated net operating loss of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents