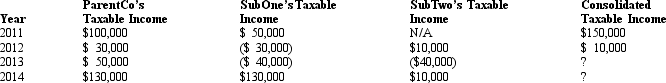

ParentCo and SubOne have filed consolidated returns since 2010.SubTwo was formed in 2012 through an asset spin-off from ParentCo.SubTwo has joined in the filing of consolidated returns since then.Taxable income computations for the members include the following.None of the group members incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.  If ParentCo does not elect to forgo the carryback of the 2013 net operating loss,how much of the 2013 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2013 net operating loss,how much of the 2013 consolidated net operating loss is carried back to offset prior years' income?

A) $80,000.

B) $40,000.

C) $30,000.

D) $0.

Correct Answer:

Verified

Q41: ParentCo owned 100% of SubCo for the

Q45: ParentCo owned 100% of SubCo for the

Q66: The Philstrom consolidated group reported the following

Q67: Which of the following statements is true

Q67: ParentCo purchased 100% of SubCo's stock on

Q70: ParentCo and SubCo had the following items

Q70: The Harris consolidated group reports a net

Q72: Which of the following items is not

Q73: The Philstrom consolidated group reported the following

Q75: ParentCo and SubCo have filed consolidated returns

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents