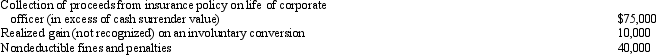

Platinum Corporation,a calendar year taxpayer,has taxable income of $500,000.Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes,Platinum Corporation's current E & P is:

Disregarding any provision for Federal income taxes,Platinum Corporation's current E & P is:

A) $455,000.

B) $535,000.

C) $545,000.

D) $625,000.

E) None of the above.

Correct Answer:

Verified

Q37: Certain dividends from foreign corporations can be

Q40: Regardless of any deficit in current E

Q47: Duck Corporation is a calendar year taxpayer

Q51: Tern Corporation, a cash basis taxpayer, has

Q64: Orange Corporation has a deficit in accumulated

Q66: Gander, a calendar year corporation, has a

Q68: Maria and Christopher each own 50% of

Q70: Which of the following statements is incorrect

Q72: Tungsten Corporation, a calendar year cash basis

Q79: Tangelo Corporation has an August 31 year-end.Tangelo

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents