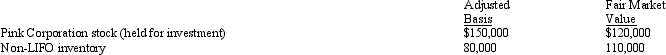

In the current year,Warbler Corporation (E & P of $250,000) made the following property distributions to its shareholders (all corporations) :  Warbler Corporation is not a member of a controlled group.As a result of the distribution:

Warbler Corporation is not a member of a controlled group.As a result of the distribution:

A) The shareholders have dividend income of $200,000.

B) The shareholders have dividend income of $260,000.

C) Warbler has a recognized gain of $30,000 and a recognized loss of $30,000.

D) Warbler has no recognized gain or loss.

E) None of the above.

Correct Answer:

Verified

Q59: Scarlet Corporation (a calendar year taxpayer)has taxable

Q67: On January 1, Gull Corporation (a calendar

Q78: Glenda is the sole shareholder of Condor

Q81: Rust Corporation distributes property to its sole

Q84: Which one of the following statements about

Q88: Starling Corporation has accumulated E & P

Q90: Samantha owns stock in Pigeon Corporation (basis

Q95: Ten years ago, Carrie purchased 2,000 shares

Q98: Navy Corporation has E & P of

Q98: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents