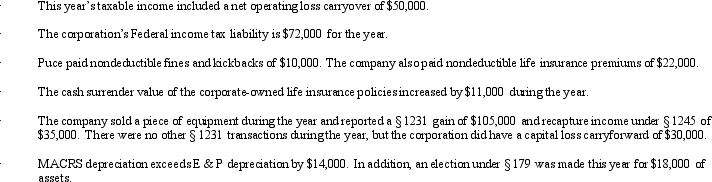

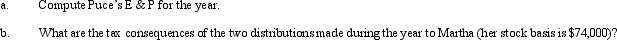

Puce Corporation,an accrual basis taxpayer,has struggled to survive since its formation,six years ago.As a result,it has a deficit in accumulated E & P at the beginning of the year of $340,000.This year,however,Puce earned a significant profit;taxable income was $240,000.Consequently,Puce made two cash distributions to Martha,its sole shareholder: $150,000 on July 1 and $200,000 December 31.The following information might be relevant to determining the tax treatment of the distributions.

Correct Answer:

Verified

Q94: Daisy Corporation is the sole shareholder of

Q111: Thistle Corporation declares a nontaxable dividend payable

Q145: Scarlet Corporation is an accrual basis, calendar

Q147: Stephanie is the sole shareholder and president

Q152: Ashley, the sole shareholder of Hawk Corporation,

Q154: Sylvia owns 25% of Cormorant Corporation. Cormorant

Q160: On January 1, Tulip Corporation (a calendar

Q170: Briefly describe the reason a corporation might

Q173: Timothy owns 100% of Forsythia Corporation's stock.

Q179: Goldfinch Corporation distributes stock rights to its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents