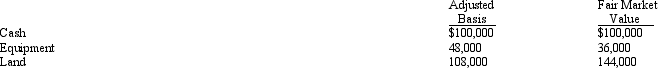

Kathleen transferred the following assets to Mockingbird Corporation.  In exchange,Kathleen received 40% of Mockingbird Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Kathleen received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Mockingbird Corporation five years ago.

In exchange,Kathleen received 40% of Mockingbird Corporation's only class of stock outstanding.The stock has no established value.However,all parties sincerely believe that the value of the stock Kathleen received is the equivalent of the value of the assets she transferred.The only other shareholder,Rick,formed Mockingbird Corporation five years ago.

A) Kathleen has no gain or loss on the transfer.

B) Mockingbird Corporation has a basis of $48,000 in the equipment and $108,000 in the land.

C) Kathleen has a basis of $256,000 in the stock of Mockingbird Corporation.

D) Mockingbird Corporation has a basis of $36,000 in the equipment and $144,000 in the land.

E) None of the above.

Correct Answer:

Verified

Q42: If a shareholder owns stock received as

Q43: Mitchell and Powell form Green Corporation. Mitchell

Q45: Tom and George form Swan Corporation with

Q50: Rick transferred the following assets and liabilities

Q52: Lucy and Marta form Blue Corporation. Lucy

Q53: Three individuals form Skylark Corporation with the

Q54: Dick,a cash basis taxpayer,incorporates his sole proprietorship.He

Q56: Amy owns 20% of the stock of

Q73: Sarah and Tony (mother and son) form

Q100: Eve transfers property (basis of $120,000 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents