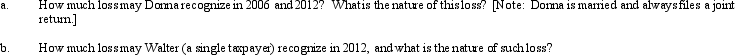

In 2005,Donna transferred assets (basis of $300,000 and fair market value of $250,000)to Egret Corporation in return for 200 shares of § 1244 stock.Due to § 351,the transfer was nontaxable;therefore,Donna's basis in the Egret stock is $300,000.In 2006,Donna sells 100 of these shares to Walter (a family friend)for $100,000.In 2012,Egret Corporation files for bankruptcy,and its stock becomes worthless.

Correct Answer:

Verified

Q70: Carl transfers land to Cardinal Corporation for

Q72: Kirby and Helen form Red Corporation. Kirby

Q81: Barry and Irv form Rapid Corporation.Barry transfers

Q84: Sean,a sole proprietor,is engaged in a service

Q86: In order to encourage the redevelopment of

Q92: George (an 80% shareholder) has made loans

Q101: Stock in Merlin Corporation is held equally

Q102: For transfers falling under § 351, what

Q104: When forming a corporation, a transferor-shareholder may

Q106: What is the rationale underlying the tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents