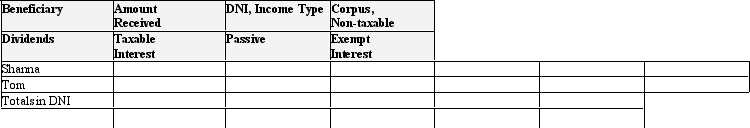

The Willa estate reports $100,000 DNI,composed of $50,000 dividends,$20,000 taxable interest,$10,000 passive income,and $20,000 tax-exempt interest.Willa's two noncharitable income beneficiaries,Shanna and Tom,receive distributions of $75,000 each.How much of each class of income is deemed to have been distributed to Shanna? To Tom? Use the following template to structure your answer.

Correct Answer:

Verified

Q122: The Gibson Estate is responsible for the

Q123: The Purple Trust incurred the following items

Q124: Counsell is a simple trust that correctly

Q125: The Yan Estate is your client,as are

Q127: The Booker Trust is your client.Complete the

Q127: Explain how the Federal income tax law

Q131: The trustee of the Miguel Trust can

Q134: The Raja Trust operates a welding business.

Q140: The Circle Trust has some exempt interest

Q146: Consider the term fiduciary accounting income as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents