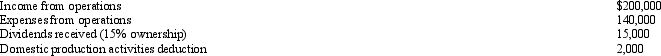

During the current year,Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

A) $9,000.

B) $7,500.

C) $6,650.

D) $6,450.

E) None of the above.

Correct Answer:

Verified

Q48: Jade Corporation, a C corporation, had $100,000

Q63: Emerald Corporation,a calendar year C corporation,was formed

Q66: During 2012, Sparrow Corporation, a calendar year

Q67: During the current year,Owl Corporation (a C

Q70: Grebe Corporation, a closely held corporation that

Q73: Red Corporation,which owns stock in Blue Corporation,had

Q75: Which of the following statements is incorrect

Q77: Which of the following statements is incorrect

Q78: During the current year, Violet, Inc., a

Q79: Orange Corporation owns stock in White Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents