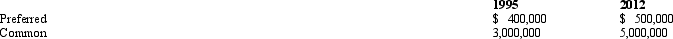

Dustin owns all of the stock of Gold Corporation which includes both common and preferred shares.The preferred stock is noncumulative,has no redemption date,and possesses no liquidation preference.In 1995,Dustin makes a gift to his adult children of all of the common stock.He dies in 2012 still owning the preferred stock.The value of the Gold stock on the relevant dates is:  One of the tax consequences of this estate freeze is:

One of the tax consequences of this estate freeze is:

A) Dustin's gross estate includes $0 as to the stock.

B) Dustin's gross estate includes $5,000,000 as to the stock.

C) Dustin made a gift of $400,000 in 1995.

D) Dustin made a gift of $3,400,000 in 1995.

E) None of the above is correct.

Correct Answer:

Verified

Q54: Which, if any, are characteristics of the

Q59: In satisfying the more-than-35% test for qualification

Q70: To prove successful in freezing the value

Q71: In satisfying the more-than-35% test of §

Q73: In 2012,Donna's father dies and leaves her

Q75: Which statement is correct concerning the rules

Q76: Which, if any, of the items listed

Q79: At the time of Corinne's death in

Q80: In a typical "estate freeze" involving stock:

A)The

Q81: Curt owns the following assets which he

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents