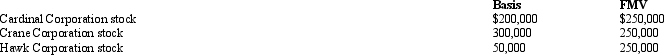

Eric,age 80,has accumulated about $6 million in net assets.Among his assets are the following marketable securities held as investments.  Eric would like to donate (either by lifetime or testamentary transfer) $250,000 in value to his church.In addition,to consummate a land deal,he needs $250,000 in cash.Looking solely to tax: considerations and using only the assets described above,Eric's best choice is to:

Eric would like to donate (either by lifetime or testamentary transfer) $250,000 in value to his church.In addition,to consummate a land deal,he needs $250,000 in cash.Looking solely to tax: considerations and using only the assets described above,Eric's best choice is to:

A) Donate by gift to the church the Crane stock and sell the Hawk stock now.

B) Donate by death to the church the Hawk stock and sell the Cardinal stock now.

C) Donate by gift to the church the Hawk stock and sell the Crane stock now.

D) Donate by gift to the church the Cardinal stock and sell the Hawk stock now.

E) None of the above is an attractive technique.

Correct Answer:

Verified

Q61: Paul dies and leaves his traditional IRA

Q93: In 1990,Gloria purchased as an investment unimproved

Q94: Which,if any,of the following procedures reduces both

Q96: In 2010,Pam makes a gift of land

Q97: In 1989,Tony,a resident of New York,purchases realty

Q99: Lisa has been widowed three times.Her first

Q100: In April 2012,Tim makes a gift of

Q102: Art makes a gift of stock in

Q103: Barney creates a trust,income payable to Chloe

Q116: Wesley has created an irrevocable trust: life

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents