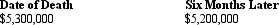

Fred and Pearl always have lived in a community property state.At the time of Fred's prior death in 2012,they held stock that cost them $600,000 but was valued as follows.

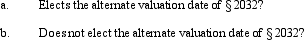

Under Fred's will,his half of the stock passes to their daughter,Brandi.What income tax basis will Pearl and Brandi have in the stock,if Fred's estate:

Under Fred's will,his half of the stock passes to their daughter,Brandi.What income tax basis will Pearl and Brandi have in the stock,if Fred's estate:

Correct Answer:

Verified

Q97: Which, if any, of the following items

Q102: Art makes a gift of stock in

Q103: Barney creates a trust,income payable to Chloe

Q104: In each of the following independent situations,describe

Q105: At the time of her death in

Q107: In April 2011,Ed gives his mother,Grace,real estate

Q109: After a prolonged illness,Claire has been diagnosed

Q110: In February 2011,Taylor sold real estate (adjusted

Q111: Bob and Paige are married and live

Q116: Wesley has created an irrevocable trust: life

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents