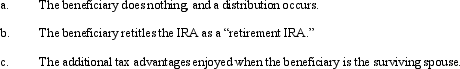

In connection with a traditional IRA that is transferred at death,comment on the tax implications of each of the following.

Correct Answer:

Verified

Q106: One of the objectives of establishing a

Q107: The quantity of stock that a decedent

Q123: Even though it results in more estate

Q125: In terms of future estate tax (and

Q126: What is the major disadvantage of an

Q127: Using investments worth $1 million,Roland establishes a

Q129: Giselle,a widow,has an extensive investment portfolio that

Q131: Warren sells property that he inherited five

Q132: In arriving at the value of stock

Q133: If the special use valuation method of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents