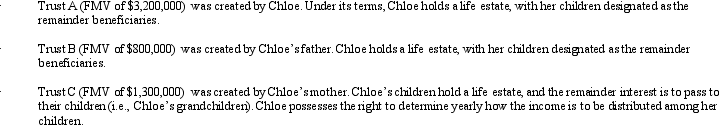

At the time of her death in 2012,Chloe was involved in three trust arrangements.Details regarding these trusts are summarized below.

As to these trusts,how much will be included in Chloe's gross estate?

As to these trusts,how much will be included in Chloe's gross estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q127: Calvin's will passes $800,000 of cash to

Q134: Tom and Jean are husband and wife

Q135: Homer and Laura are husband and wife.At

Q136: In 2010,Glen transferred several assets by gift

Q137: Jacob and Emma are husband and wife

Q138: At the time of his death on

Q140: June made taxable gifts as follows: $400,000

Q143: The Federal gift and estate taxes were

Q144: Byron and Amanda are heirs of the

Q146: Walt dies intestate (i.e. ,without a will)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents