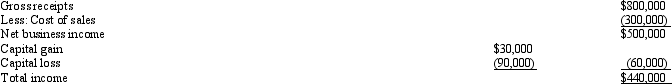

Jake,an individual calendar year taxpayer,incurred the following transactions.  Assuming that any error in timely reporting these amounts was inadvertent,how much omission from gross income would be required before the six-year statute of limitations would apply?

Assuming that any error in timely reporting these amounts was inadvertent,how much omission from gross income would be required before the six-year statute of limitations would apply?

A) More than $110,000.

B) More than $132,500.

C) More than $207,500.

D) The six-year rule does not apply here.

Correct Answer:

Verified

Q51: Juanita, who is subject to a 35%

Q61: Concerning the penalty for civil tax fraud:

A)Fraudulent

Q67: Roger prepared for compensation a Federal income

Q68: Which of the following is subject to

Q69: A registered tax return preparer who is

Q71: Minnie, a calendar year taxpayer, filed a

Q75: Freddie has been assessed a preparer penalty

Q79: The usual three-year statute of limitations on

Q82: The privilege of confidentiality applies to a

Q86: Megan prepared for compensation a Federal income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents