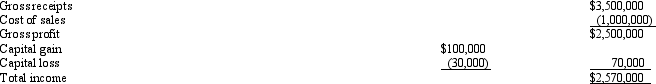

Loren Ltd. ,a calendar year taxpayer,had the following transactions,all of which were properly reported on a timely filed return.Presuming the absence of fraud,how much of an omission from gross income must occur for Loren before the six-year statute of limitations applies? Show your computations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Certain individuals are more likely than others

Q126: Leo underpaid his taxes by $250,000.Portions of

Q129: Bettie,a calendar year individual taxpayer,files her 2011

Q137: The IRS periodically updates its list of

Q139: LaCharles made a charitable contribution of property

Q139: Describe the following written determinations that are

Q140: Troy Center Ltd.withheld from its employees' paychecks

Q144: Chung's AGI last year was $180,000. Her

Q153: The Treasury issues "private letter rulings" and

Q160: What are the chief responsibilities of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents